x402 + ERC-8004: Why the Facilitator is the “Last Mile” of the Agent Economy

If we break the “agent economy” down into an engineering problem, it really comes down to just two things: trust and settlement.

Trust answers questions like: Who are you? How have you performed in the past? Can what you output this time be verified?

Settlement answers: How can I complete payment in a single HTTP call and generate results that can be reconciled for accounting?

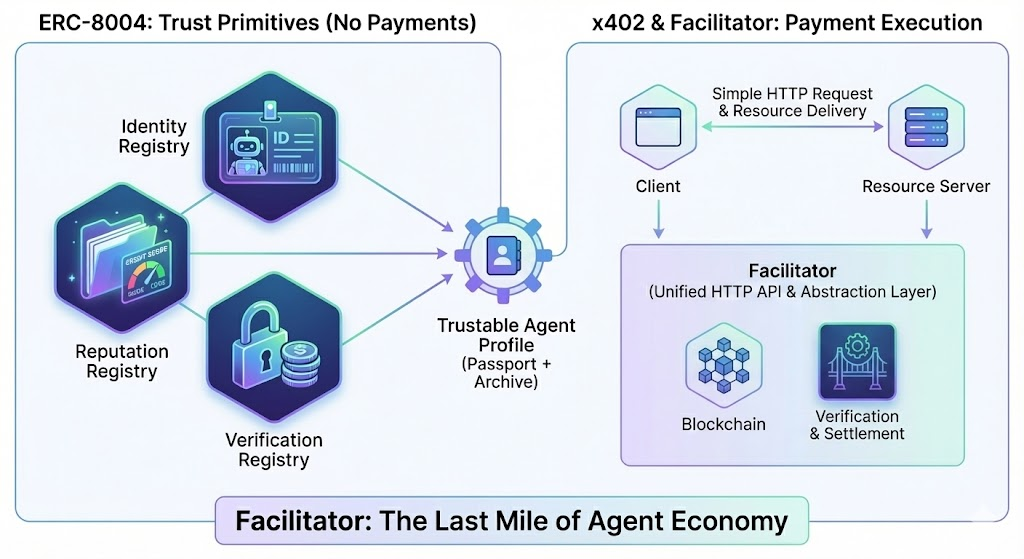

ERC-8004 and x402 standardize these two pieces respectively, but there’s still a missing layer between them — an “execution layer” that actually makes the system run end to end. That layer is the Facilitator.

ERC-8004: Composable “trust primitives” for agents — intentionally not about payments

ERC-8004 introduces three lightweight registries:

● Identity Registry: issues each AI agent a unique on-chain NFT identity, establishing it as a recognized digital entity (like a digital ID card).

● Reputation Registry: builds a dynamic credit system based on verifiable on-chain interaction records (like a credit file).

● Verification Registry: provides trustworthy guarantees for agent behavior through multiple mechanisms such as economic staking and Trusted Execution Environment (TEE) attestations.

What it solves is discoverability and evaluability across platforms and organizations. But ERC-8004 itself does not handle “how to charge per call” or “how to settle on-chain.” Some integration docs even state this explicitly: payments are outside the scope of the standard, and at most you can reference proof of payment inside reputation data.

So ERC-8004 is like a “passport + archive”: you can use it for access control, risk management, whitelists/blacklists, and policy tiers — but it won’t actually collect the money for you.

x402: Enables paid access to HTTP resources, but leaves on-chain execution complexity to the ecosystem

x402 has a very straightforward goal: standardize paid access using the familiar HTTP request–response pattern. A typical flow looks like this: the client requests a resource → the server returns a payment requirement → the client submits payment → the server delivers the resource. x402 can also support different settlement methods, using a scheme to distinguish the meaning and semantics of each payment/settlement option.

The challenge is: a protocol can standardize how to describe the process, but for real production systems, what matters more is standardizing how to execute it. Once you move into implementation, the resource server has to deal with a long list of on-chain execution details — signature checks, transaction broadcasting, confirmation waiting, retry logic on failure, reconciliation, monitoring, and risk controls. If every seller implements these on their own, the ecosystem will quickly fragment: everyone may claim they “support x402,” but the success semantics, error handling, and idempotency strategies will all differ. In that world, callers can’t form stable, reliable expectations.

Facilitator: the “payment execution layer” of the x402 ecosystem, built for production

Coinbase’s x402 docs are very clear about what a Facilitator is: it’s an optional — but recommended — service that simplifies payment verification and settlement between buyers and sellers. At its core, it does two things: verification and on-chain settlement.

DeepWiki describes this layer in more engineering terms: a Facilitator should provide a standardized HTTP API, so that resource servers don’t need to deal with blockchain complexity directly.

That’s why people call it the “last mile” of the agent economy: without a Facilitator, x402 effectively requires every seller to have strong on-chain engineering capabilities. With a Facilitator, sellers can plug in directly — making it much easier for the ecosystem to scale.

From a technical perspective: Facilitators answer four must-have questions for real-world deployment

1) Strip blockchain complexity out of the resource server

● Many x402 project landing pages put the value proposition very plainly: the Facilitator handles verification and settlement, so sellers don’t need to run blockchain infrastructure themselves.Without a Facilitator: every provider of a paid API has to build a full “payments stack” on their own — connecting to chains, broadcasting transactions, waiting for confirmations, handling failures, reconciling accounts, monitoring, setting up alerts, and so on.

● With a Facilitator: the provider plugs into a “unified cashier / collection service” and focuses on delivering the product or service, while the professional layer handles payments.

Analogy: if you run an online store, you probably don’t want to integrate with every bank and build your own clearing and settlement system — so you use PayPal or Stripe instead.

2) Standardize “success semantics” to prevent ecosystem fragmentation

● Without a Facilitator: Seller A might say “your signature is enough — payment accepted,” Seller B might require “three on-chain confirmations,” and Seller C might use yet another rule set.

Result: everyone claims to support x402, but the user experience is completely different. Clients/agents can’t write stable, reliable autopay logic.

● With a Facilitator: it turns “verification, settlement, and failure handling” into a single standardized workflow with consistent result formats. When everyone follows the same “cashier rules,” the ecosystem can scale without everyone talking past each other.

Analogy: the rules of a match have to be unified — if every referee uses different standards, the game can’t be played.

3) Bring ERC-8004 trust signals into real transaction decisions

ERC-8004 provides three types of trust inputs — identity, reputation, and verification — but they only create economic value when they’re actually used in decision-making. If these signals are just displayed on a page and don’t affect transactions, it’s like “the shop posts a business license on the wall, but nobody checks it at checkout.”A Facilitator sits right at the payment gateway, which makes it the perfect place to apply these trust signals in practice:

● Low reputation: require higher prepayment, impose tighter rate limits, or apply stricter review

● High reputation: fewer steps, faster approval, and higher spending limits

Analogy: people with high credit scores often pay smaller hotel deposits and get faster service; people with low scores may need extra deposits and additional checks.

4) Support high-frequency micro-payments

A lot of solutions can “take payments” in a demo, but real environments quickly expose the hard problems: network congestion, failed transactions, double charges, service instability, and messy reconciliation. These are the issues that determine whether something can actually scale into a business.That’s where a Facilitator matters. It treats all the “dirty work” as its core job — retries, rate limiting, monitoring, risk controls, logging, and reconciliation — so the ecosystem feels like a real payment system, not an experiment.

Analogy: you don’t just want a car that can run once — you want one you can drive every day, with maintenance support and a clear trail when something goes wrong.

Summary: ERC-8004 is the trust layer, x402 is the interaction layer, and the Facilitator is the execution layer

In one technical sentence, their relationship looks like this:

● ERC-8004: defines cross-platform identity, reputation, and verification — making trust signals portable and reusable.

● x402: defines and enables paid interactions in HTTP-based scenarios.

● Facilitator: provides a standardized, reusable, and replaceable payment execution layer — so sellers don’t need to be on-chain engineering teams, trust signals can actually influence transaction policies, and the ecosystem becomes truly production-ready.