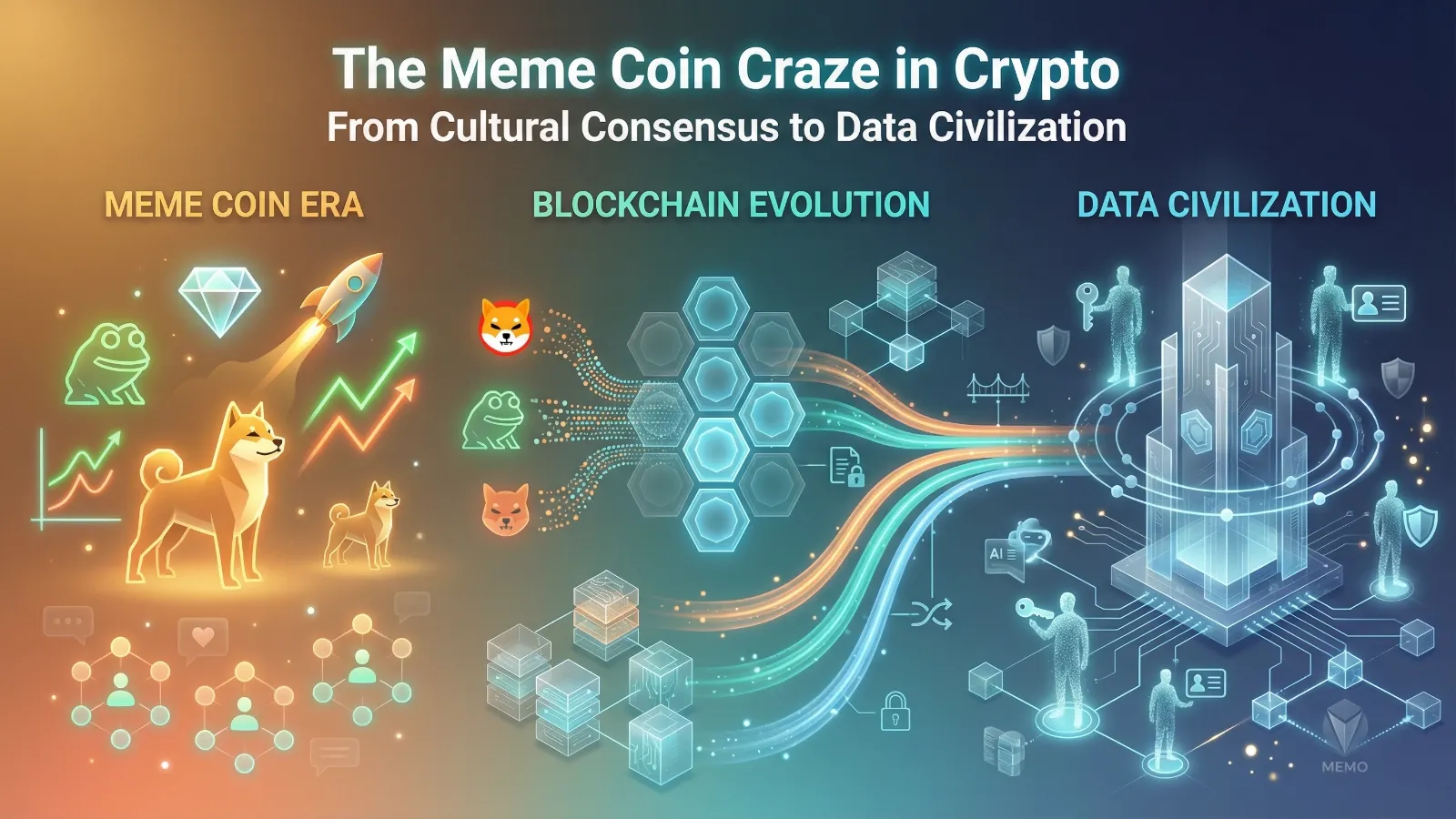

The Meme Coin Craze in Crypto: Understanding the Hype and What It Means for Blockchain’s Future

Over the past few years, crypto markets have witnessed a thrilling phenomenon: the explosive rise of meme coins. These whimsical digital assets — often inspired by internet culture and community energy — have captured mainstream attention and brought a new wave of participants into the blockchain space. From viral tweets to TikTok trends, meme coins have created an unprecedented level of engagement, sparking debates about value, speculation, and the future of digital finance. But beyond colorful logos and viral social posts, the meme coin craze reveals deeper trends reshaping the future of blockchain technology, including how innovative platforms like MEMO are positioning themselves at the intersection of community, data ownership, and decentralized infrastructure.

Meme Coins: More Than Just a Fad

Meme coins like Dogecoin and Shiba Inu surged in popularity due to their strong communities, social media-driven hype, and accessibility for new crypto users. Unlike Bitcoin or Ethereum — which are often discussed in terms of utility, decentralization, or technological milestones — meme coins typically thrive on social engagement, viral momentum, and speculative interest. This has led to parabolic price swings and dramatic market narratives, yet these coins also highlight key developments in the broader crypto landscape:

Mass Adoption Through Culture

Meme coins transformed what was once a niche financial technology into a cultural movement. By tapping into internet memes, humor, and community-driven campaigns, they lowered the psychological barrier for entry, especially for everyday investors who might otherwise feel intimidated by technical blockchain concepts. Social media platforms like Twitter, Reddit, and Discord became launchpads for new coins, proving that culture can be as influential as code in driving adoption.

Community as a Value Driver

In traditional finance, fundamental value is often derived from earnings, cash flows, or tangible assets. In crypto, communities themselves can become a form of value. Meme coins demonstrated how collective belief, social engagement, and coordinated digital action can influence markets in unprecedented ways. This “social valuation” concept is now being explored by new DeFi and Web3 protocols, showing that the line between social capital and economic capital is increasingly blurred.

Innovation and Experimentation

While many meme coins remain speculative, the traction they gained pushed developers and innovators to experiment with new use cases, tokenomics designs, and governance models. Some projects introduced staking, yield farming, or DAO-based decision-making into their communities. Others experimented with NFT integration or AI-powered engagement mechanisms. In this way, meme coins indirectly accelerated the development of participatory and socially driven Web3 applications.

Why Meme Coins Matter for Blockchain’s Future

The meme coin craze isn’t just about short-term gains; it reflects a maturing ecosystem where crypto is no longer purely driven by institutional capital or tech enthusiasts. Instead, it is increasingly shaped by mainstream culture, collective identity, and social momentum. This cultural shift is significant for several reasons:

- Broader On-Ramp for Users

Meme coin narratives attracted millions of new investors to crypto wallets, exchanges, and decentralized finance platforms. These participants often start with small investments driven by curiosity, entertainment, or social influence, but over time, many explore more complex blockchain products. In effect, meme coins are serving as a gateway to a broader adoption of crypto technologies. - Community-Powered Innovation

Open-source contributions, decentralized governance experiments, and token incentive models — first tested in meme coin communities — are now foundational elements in many serious blockchain protocols. By demonstrating that a passionate user base can drive adoption and innovation, meme coins have reshaped the way projects approach engagement and growth. - Market Layer Evolution

The hype around meme coins highlighted the need for robust infrastructure to support a diverse array of digital assets, from simple tokens to complex data assets and identity systems. Platforms that integrate identity verification, data ownership, and interoperable protocols are increasingly important as crypto moves beyond speculation toward real-world utility.

Enter MEMO: A New Era for Data and Ownership on Blockchain

While meme coins captured attention with viral energy and social media virality, the blockchain space is evolving toward more sustainable and impactful innovations. One of the most important shifts is the move from simple token systems to data-centric and identity-centric infrastructures. This is where MEMO is leading the way.

MEMO is not just another blockchain project; it is a modular, AI-driven, user-centric data blockchain designed to solve emerging challenges in the Web3 era — particularly around data storage, privacy, assetization, and interoperability. Unlike typical token-driven projects, MEMO focuses on the value of data as a first-class asset and ensures users remain in full control of their digital identity.

Beyond Tokens: Data as a First-Class Asset

Today, most blockchain ecosystems prioritize financial assets: crypto tokens, NFTs, and governance tokens. But data itself represents an enormous untapped value. MEMO provides a decentralized data layer, giving users ownership over their information — from personal details to AI training datasets.

Traditional centralized storage systems, like cloud servers, are prone to single points of failure, security breaches, and privacy violations. MEMO’s decentralized architecture separates storage, processing, and access, delivering a secure and resilient solution that enhances transparency and trust. This approach ensures that data is both protected and monetizable, forming the foundation for the next generation of blockchain applications.

Decentralized Identity (DID): Your Data, Your Control

At MEMO’s core is Decentralized Identity (DID) — a self-sovereign identity framework that ensures users truly own their digital identity and all associated data. In a world where crypto and Web3 applications increasingly rely on reputation, trust, and personalized interactions, DID becomes a critical infrastructure layer. It parallels the role of meme coin communities, which demonstrated early on that collective participation and social proof can drive both engagement and value.

A New Data Economy: Data Wallets and Data Markets

MEMO introduces innovative components like Data Wallets and Data Markets:

- Data Wallets allow users to manage encrypted data assets similar to tokens, offering fine-grained access control and privacy protections.

- Data Markets create decentralized marketplaces where users can securely trade data assets, backed by smart contracts and blockchain governance.

By integrating these elements, MEMO transitions crypto from speculative finance — as seen in meme coin hype — toward a broader economy where data itself becomes a tradable, secure, and user-owned asset.

Implications for the Future

Meme coins broke the ice for mainstream blockchain participation, proving that culture, community, and creativity are as crucial as technology. However, as crypto matures, projects like MEMO are shaping the next phase: a data-centric blockchain economy where identity, privacy, and interoperable infrastructure unlock real utility and sustainable growth.

This evolution is poised to influence everything from AI training data markets to decentralized applications that respect user sovereignty, opening new frontiers for developers, enterprises, and individual users alike in the rapidly evolving Web3 ecosystem.